- #TURBOTAX 1040X EFILE 2020 HOW TO#

- #TURBOTAX 1040X EFILE 2020 FULL#

- #TURBOTAX 1040X EFILE 2020 SOFTWARE#

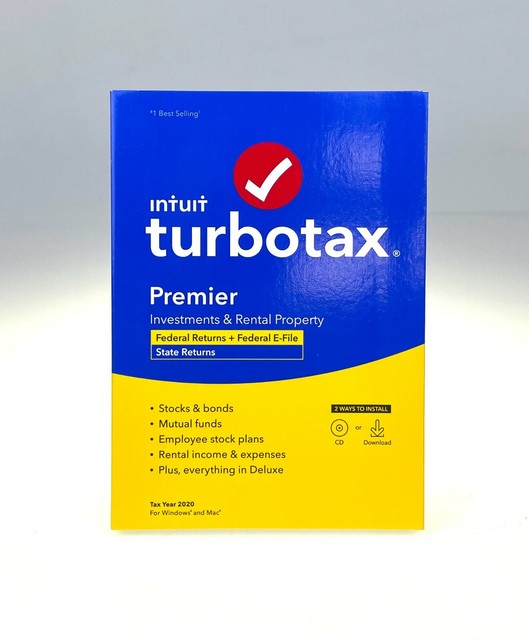

#TURBOTAX 1040X EFILE 2020 SOFTWARE#

We strive to use our software as a source for greater good for everyday Americans. It all looks good except it says I cannot e-file an amended return on turbotax. We have aimed to make filing taxes as ez and simple as possible, so you can get through it in 30 minutes or less and onto more important everyday matters that require your attention. I am changing my filing status from HOH to single in my 2020 amended return. We have to work long hours, take care of our families and do it all ourselves.

We want you to get to the finish line safe and sound.Īs middle class Americans, we don't have chefs and chauffeurs. We have also added free customer service to the mix to offer you the "just in time" help you need to get through any road blocks you encounter during your tax filing process. Our ez do-it-yourself online software is designed by us average Americans to help you achieve just that. We are folks, who are very proud to represent the average American population and play a part in serving its needs.Īs hard working Americans, we would want our tax returns to be filed smoothly, accurately and on time with no hassles. How do I clear and start over in TurboTax Online If you havent submitted payment, deducted the TurboTax fee from your refund, or registered your product, you can still restart your return. The ezTaxReturn team is made up of Americans from all walks of life from a multitude of socio-economic diversities. Note that 2019 regular or amended returns can no longer be e-filed (only 2020, 2021, and 2022 forms are eligible for e-file). How do I file an IRS extension (Form 4868) in TurboTax Online File an extension in TurboTax Online before the deadline to avoid a late filing penalty. When a Dependent Must File a Tax Return.Wheres My Refund INTIME INBiz INfreefile.

#TURBOTAX 1040X EFILE 2020 FULL#

For TurboTax Live Full Service, your tax expert will amend your 2022 tax return for you through. If you did not file an original return but you filed an amended federal return (1040x). Terms and conditions may vary and are subject to change without notice. Taxpayers whose AGI is 73,000 or less qualify for a free federal tax return. Our partners deliver this service at no cost to qualifying taxpayers. You can now follow the prompts with the program to complete your amended return, or you can. It provides two ways for taxpayers to prepare and file their federal income tax online for free: Guided Tax Preparation provides free online tax preparation and filing at an IRS partner site. Choose Amended Return (Form 1040X) and click Go To. Click Take Me To in the top right corner.

#TURBOTAX 1040X EFILE 2020 HOW TO#

Online products include Federal e-file at no extra cost + 49 per state efile. Make changes to your 2022 tax return online for up to 3 years after it has been filed and accepted by the IRS through. When you’re ready, here’s how to prepare your amended return: Open your originally filed return in the H&R Block Tax Software. Tax Filing Requirements for College Students In TaxAct, how you prepare your amended return has not changed. TurboTax and H&R Block allow you to pay an additional fee to get live help.

0 kommentar(er)

0 kommentar(er)